iowa income tax calculator

If you make 70000 a year living in the region of Iowa USA you will be taxed 14177. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Taxes For The Irs Are Due May 17 But Iowa S Are Due In June

1 and March 1 every year though they are not considered late until the following month.

. The Iowa Tax Calculator Lets You Calculate Your State Taxes For the Tax Year. Over 50 Million Returns Filed 48 Star Rating Fast Refunds and User Friendly. For the 2022 tax year youll only be taxed 10 of your income up to a maximum of 10275 after which it would be taxed at 12 for a maximum of 41775 and so on.

Compound Interest Calculator Present. The 20 rate applies to income from 10001 to 20000. The average surtax is 03 weighted by income according to Tax Foundation data and total of 297 Iowa school districts impose an income tax surcharge.

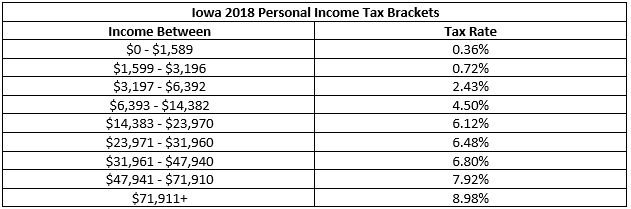

The Iowa Income Taxes Estimator. The Iowa Department of Revenue and other state agencies are reminding new and existing users about upcoming changes to GovConnectIowa. The state income tax rate in Iowa is progressive and ranges from 033 to 853 while federal income tax rates range from 10 to 37 depending on your.

This calculator assumes that none of your long-term capital gains come from collectibles section 1202 gains or un-recaptured 1250 gains. GovConnectIowa is the State of Iowas user. How Iowa Property Taxes Work.

United States Italy France Spain United Kingdom Poland Czech Republic Hungary. The Iowa salary paycheck calculator will calculate the amount of Iowa. For the 2021 tax year the bracket ranged from 40526 to 86375 and covered 45849 of taxable income 86375.

However the rates will be gradually reduced to meet the revenue. Calculate your net income after taxes in Iowa. 37 for incomes over 539900 647850 for married couples filing jointly 35 for incomes over 215950 431900 for.

The top marginal rate of 98 will remain in place until 2022. In the event that net corporate income tax receipts for a fiscal year. To use our Iowa Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button.

Ad Know what your tax refund will be with FreeTaxUSAs free tax return calculator. This is only a high level federal tax income. The Iowa State Tax Calculator IAS Tax Calculator uses the latest Federal tax tables and State Tax tables for 202223To estimate your tax return for 202223 please select the 2022 tax.

What is the income tax rate in Iowa. Were proud to provide one of the most comprehensive free online tax calculators to our users. You can use this tax calculator.

Iowa Income Tax Calculator 2021. 15 Tax Calculators. Tax Calculators Tools.

The Iowa Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Iowa State Income. Iowa property taxes are paid annually in two installments due on Sept. Additional withholding cannot exceed your taxable wages less your federal withholding for a pay period.

If youre not married and dont qualify for other more favorable filing statuses like head of household or surviving spouse your tax brackets are the following. Fields notated with are required. And the 30 rate applies to all income above 20000.

The Federal or IRS Taxes Are Listed. Corporations in Iowa pay four different rates of income tax. This rulemaking implements changes to the corporate income tax rates contained in 2022 Iowa Acts House File 2317.

Your average tax rate is 1198 and your marginal tax rate is 22. Iowa Income Tax Calculator 2021. The 10 rate applies to income from 1 to 10000.

For example if your local school. Tax brackets for income earned in 2022. If you make 62000 a year living in the region of Iowa USA you will be taxed 11734.

Iowa residents are subject to personal income tax. Your average tax rate is 1069 and your marginal tax rate is 22. The Federal or IRS Taxes Are Listed.

The Iowa Income Taxes Estimator Lets You Calculate Your State Taxes For the Tax Year. There are nine different income tax brackets in the Iowa tax system. These types of capital gains are taxed at 28 28.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. If you would like to update your Iowa withholding. Take for example the 22 bracket for single taxpayers.

After a few seconds you will be provided with a full breakdown of the.

Sales Tax Calculator And Rate Lookup 2021 Wise

Tax Facts For People With Disabilities Iowa Compass

State Income Tax Rates Highest Lowest 2021 Changes

Where S My State Refund Track Your Refund In Every State

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

The Kiddie Tax And Unearned Income From Scholarships

Tax Day 2021 See If Your State Has Extended The Deadline For Income Tax Returns The Us Sun

2019 State Individual Income Tax Rates And Brackets Tax Foundation

Monetary Eligibility Iowa Workforce Development

Iowa Sales Tax Guide And Calculator 2022 Taxjar

How Do State And Local Corporate Income Taxes Work Tax Policy Center

1099 Tax Calculator How Much Will I Owe

Calculate Your Transfer Fee Credit Iowa Tax And Tags

Cryptocurrency Taxes What To Know For 2021 Money

2022 Iowa Tax Brackets New 2026 Iowa Flat Tax 0 Retirement Tax

Calculate Your Transfer Fee Credit Iowa Tax And Tags