how to reduce taxable income for high earners 2020

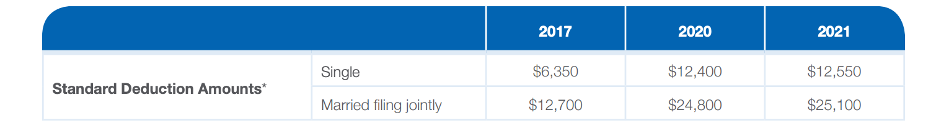

This is a cut-off date so any income earned or expenses incurred during this time are included in that year. Your taxable income would be 72000 if youre a single filer with an income of 84550 and if you were to take the 2021 standard deduction of 12550.

Who Pays Income Taxes Tax Year 2019 Foundation National Taxpayers Union

Most people wont have to worry about Roth IRA income limits but if youre a high earner keep these in mind so you dont accidentally wind up with a.

. Lets start with an overview of tax rules for high-income earners. The top federal corporate income tax rate fell from 35 percent to 21 percent beginning in 2018. The immediate benefit can lower their marginal tax bracket.

Your tax bracket depends on your taxable income and your filing status. Tax Proposals by the Biden Administration. Money market certificate of deposit CD etc.

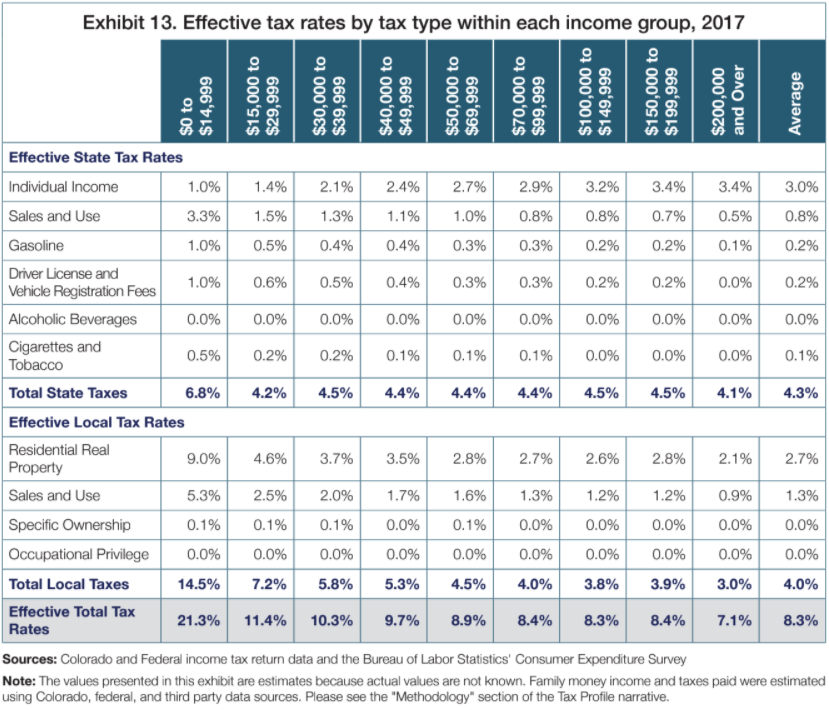

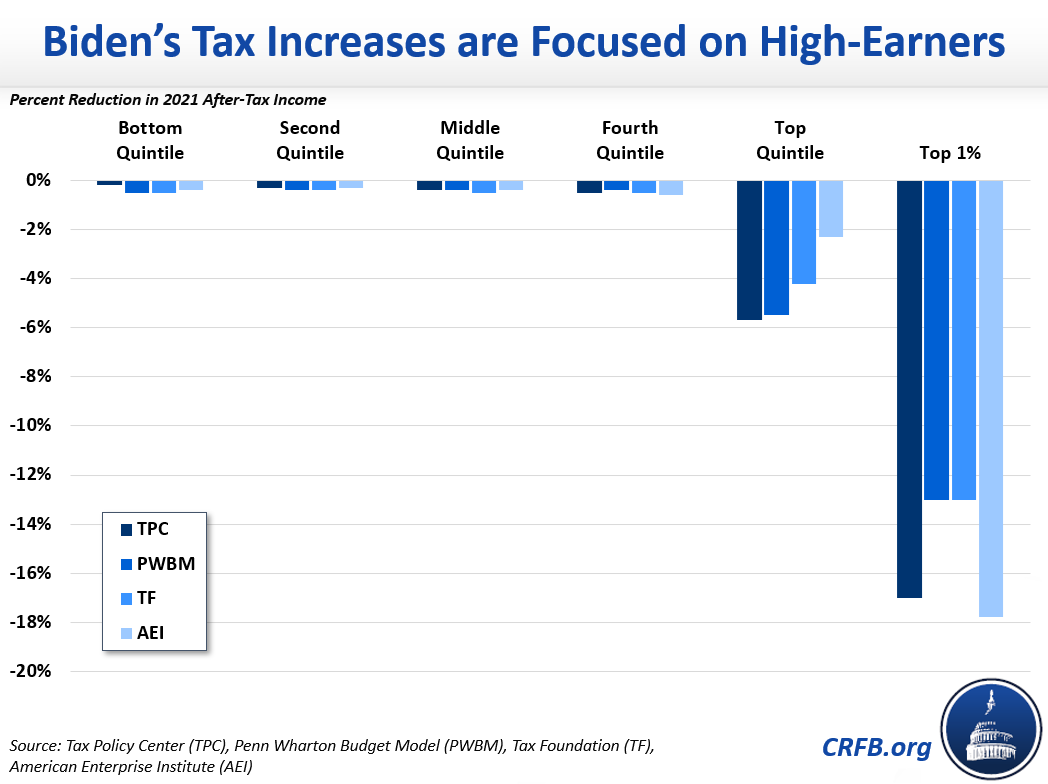

That means that if you earn more than 170050 in. High-income individuals pay more in taxes as a percentage of their taxable incomes than low-income earners. While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower.

Here are some of our favorite income tax reduction strategies for high earners. Income taxes in the United States are imposed by the federal government and most statesThe income taxes are determined by applying a tax rate which may increase as income increases to taxable income which is the total income less allowable deductionsIncome is broadly defined. Overview of Tax Rules for High-Income Earners.

It adds items that are not taxed on the standard tax rates and rejects or reduces many common tax breaks used by individual. 10 12 22 24 32 35 and 37. For 2022 they plan to file married filing separately.

In December 2017 Congress passed the Tax Cuts and Jobs Act TCJA which greatly changed the way corporations pass-through businesses and individual taxpayers were treated in the tax code. Some workers are eligible to contribute to a 401k and an IRA in the same year but high earners are prohibited from claiming tax deductions on. According to the latest federal income tax data from the IRS the top 50 percent of all taxpayers paid 971 percent of all individual income taxes while the bottom 50 percent paid the remaining 29 percent in 2018.

Joe and Heather filed a joint return for 2021 showing taxable income of 48500 and a tax of 5425. Total revenues as a share of GDP are projected to rise primarily because of increases in individual income taxes. Joe figures his share of.

Timing is key to reduce tax liabilities. The AMT increases the amount of income that is taxed for high earners. For the sake of this post we consider anybody in the top three tax brackets as a high-income earner.

COVID-19 the American Rescue Plan Act of 2021. There are seven tax brackets for most ordinary income for the 2021 tax year. Most of the tax burden fell on the highest income earners.

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. Driving those increases are the expiration of certain provisions of the 2017 tax act at the end of calendar year 2025 and real bracket creepthe process in which as income rises faster than inflation a larger proportion of income becomes subject to higher tax rates. Your financial institution or bank will send you a 1099-INT or 1099-OID form by January following a given tax year.

Interest earned from a savings account eg. Of the 48500 taxable income 40100 was Joes and the rest was Heathers. The income tax year is broadly 1 July to 30th June.

Two big changes in 2020 were self employed people were able to. This makes planning the timing of your income and expenses a. Due to the coronavirus crisis and changes in the US federal tax code from the recently passed American Rescue Plan Act of 2021 the tax filing date for individuals to pay their 2020 income taxes was moved by the IRS from April 15 2021 to May 172021.

High-Income Earners Higher-salary earners should focus on contributions to a tax-deferred account such as a 401k or traditional IRA. Individuals and corporations are directly taxable and estates and trusts may be taxable on.

Regressive Taxation In Colorado Two Competing Views Independence Institute

Biden S Tax Plan Explained For High Income Earners Making Over 400 000

Tax Strategies For High Income Earners Wiser Wealth Management

5 Outstanding Tax Strategies For High Income Earners

5 Outstanding Tax Strategies For High Income Earners

5 Smart Ways On How To Reduce Taxable Income For High Earners Debt Free Doctor

The 4 Tax Strategies For High Income Earners You Should Bookmark

How To Reduce Taxable Income For High Income Earners In 2021

How To Pay Little To No Taxes For The Rest Of Your Life

Five Different Ways Of Raising Taxes On The Wealthiest Americans

6 Strategies To Reduce Taxable Income For High Earners

Tax Strategies For High Income Earners Wiser Wealth Management

4 Ways High Earners Can Reduce Taxable Income Truenorth Wealth

Tax Strategies For High Income Earners Wiser Wealth Management

Tax Strategies For High Income Earners Wiser Wealth Management

Biden Tax Plan And 2020 Year End Planning Opportunities

How The Tcja Tax Law Affects Your Personal Finances

Would Joe Biden Significantly Raise Taxes On Middle Class Americans Committee For A Responsible Federal Budget

Here S A Breakdown Of The New Income Tax Changes Capstone Cpas